All official European Union website addresses are in the europa.eu domain.

See all EU institutions and bodiesSolutions for private investments in climate adaptation can complement public funding. Jointly developing new business models has increased private investors’ willingness to invest in Nature-based Solutions on private, rural land.

Key Learnings

About the Region

Climate Threats

Climatic shifts will bring hotter, drier summers with a higher risk of drought, and milder, wetter winters with more intense rainfall. Predictions estimate that, under global warming scenarios of 2°C and 4°C, annual average temperature could increase from 0 to 3°C and 2 to 5°C, respectively. Under a 2°C warming scenario, summer rainfall could decrease by up to 70% in the driest conditions and increase by up to 40% in the wettest. With 4°C warming, the range becomes even more extreme, from 80% less rain to 20% more. In winter, rainfall may range from 30% less to 50% more with 2°C warming, and from 20% less to 70% more under 4°C warming. At the same time, storms will become more frequent and severe, while changes to the growing season will increase pressures from pests and diseases.

Financing Nature-based Solutions for Climate Change Adaptation

Nature-based Solutions for Climate Change Adaptation

In the Axe catchment, the project team installed a series of sediment traps and scrapes at Snowdon Hill Farm to intercept runoff carrying high phosphate levels. At Chubbs Farm, leaky dams across a permanent flow slow water down and allow nutrient-rich sediment to settle out of the stream, restoring a wetland habitat beside the river. In the Camel catchment, leaky dams at Penvose campsite trap nutrient-rich sediment, preventing it from entering the river. At Trethick, a series of soil scrape/shallow ponds and riparian woodland prevents excess nutrients from entering streams and rivers.

All these changes support climate adaptation by:

- Reducing nutrient input into watercourses, therefore enhancing the resilience of freshwater ecosystems during low flows/drought conditions

- Retaining water in landscapes, contributing to flood resilience during peak precipitation

- Providing localised air-cooling during heatwaves

These ecosystem services benefit:

- Housing developers, required by law to offset the additional burden on the sewage system. Nutrient removal by Nature-based Solutions on agricultural land enables nutrient offsetting.

- Utility companies, responsible for drinking water abstraction and provision, alongside treating wastewater

- People using freshwater areas for recreation

- Infrastructure companies with assets vulnerable to flood or drought

- Farmers dependent on freshwater provision

Currently, the government, water/utility companies and non-profit organisations provide most funding for Nature-based Solutions. While Green finance is growing in the UK, the potential for private investment in Nature-based Solutions still needs to be unlocked.

Engaging Private-Sector Investors on Nature-based Solutions

To assess the extent to which Nature-based Solutions, such as ponds, scrapes, leaky dams and wetland restoration, currently present an investable proposition to private companies, Westcountry Rivers Trust (WRT) staff undertook a series of semi-structured interviews with relevant actors across the green finance sector. Participants in the bankability interviews identified 49 barriers currently preventing investment in Nature-based Solution implementation for climate adaptation. Highlighted recommendations for action, linked to the identified barriers, are:

- De-risking investments in Nature-based Solutions is essential to mobilise private funding. Risk aversion is a main barrier for private investors. Methods to contain or allocate investment risks, together with capacity building on implementation, management and monitoring of Nature-based Solutions are essential to realise investment on rural, privately owned land;

- Community Interest Companies are a promising structure to gauge private investment (including resource pooling) to serve the public good, not just make profit. Small investors can pool investments into otherwise unfeasible projects;

- Practical tools to assess the multiple benefits (environmental, social and economic) of Nature-based Solutions can be used to specify the return on investment (in monetary and non-monetary values) of Nature-based Solutions. Public organisations can provide independent monitoring. Nutrient and biodiversity offsets form a regulatory incentive to monitor and assess the benefits of Nature-based Solutions;

- A multi-benefit approach can facilitate cooperation and structure joint investments across sectoral silos since various sectors are expected to have benefits (e.g. water, nature, housing, agriculture). Governance structures for green multi-benefit finance projects remain important.

Despite substantial barriers, participants also produced clear calls for action to improve the viability of green finance schemes. They reported that, at present, the most viable models for investing in Nature-based Solutions are non-profit models, such as a Community Interest Company. Community Interest Companies are not-for-profit organisations capable of attracting investment from various sectors. Usually governed by a board representing investors and communities, they have an inherently democratic governance system. Unlike local authorities, the activities of Community Interest Companies are not legally restricted, making them a more suitable vehicle for delivering green finance projects.

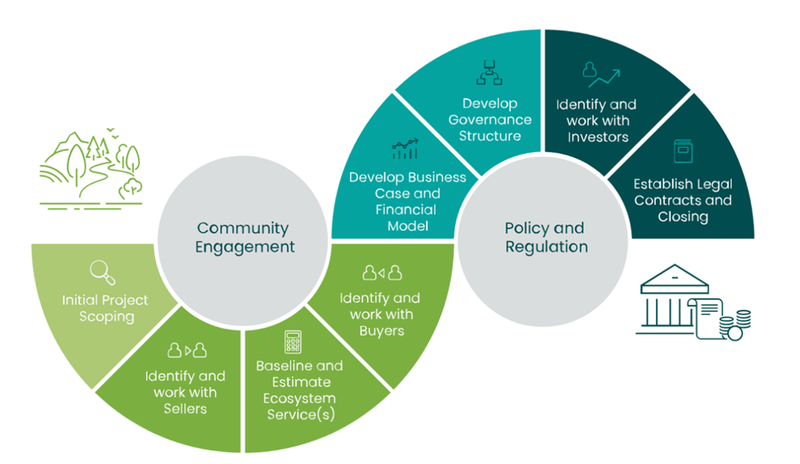

Investors usually focus on the UK’s urban centres, leaving the Westcountry with lower investment levels. The Southwest’s economy is worth about £81.6 billion (€97.1 billion), compared to London’s £562 billion (€669 billion). To attract traditional investors – like banks–, ecosystem services – like carbon storage or water supply – must generate clear, reliable revenue streams. The lack of clear revenue streams makes banks and financial institutions hesitant to invest in nature-based climate adaptation projects. However, individual companies at the local level are willing to invest in Nature-based Solutions. They often recognise their reliance on specific ecosystem services to keep their businesses running or to manage climate risks. These companies are willing to invest smaller amounts, which, if pooled, can make an otherwise unfeasible investment feasible. Each company would then receive a share of the benefits, such as carbon credits or improved water supply, along with extra gains like a better reputation or business performance. Interview participants supported this shared investment approach, as it limits the risk of companies exploiting the environment purely for profit. The Green Finance Institute in the UK has developed an Investment Readiness Toolkit (Figure 3), which outlines the process from start to finish and is a useful reference for the investment process and requirements. This highlights the important role of governance structure and the legal contracts for green investment, which are still early in development and require time to establish.

Financing Models for Future Projects

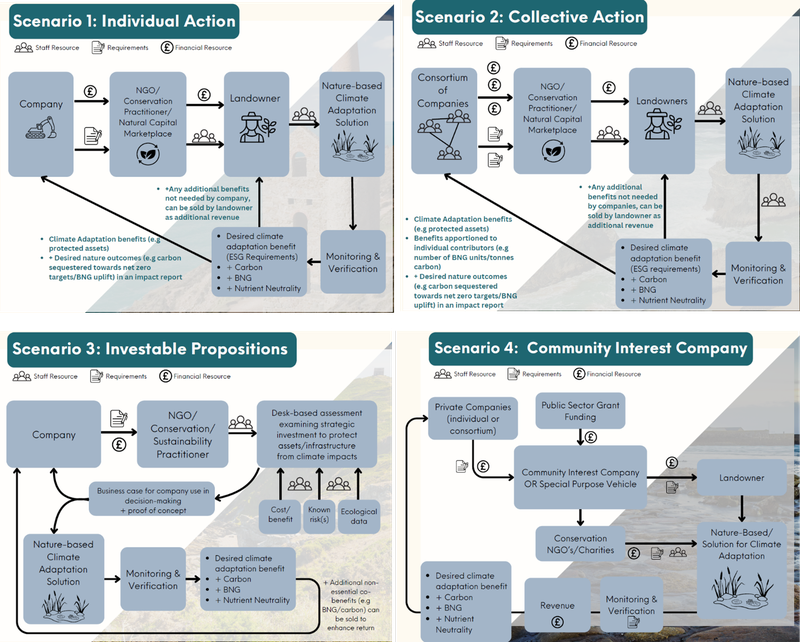

To validate and expand upon the results of the bankability interviews, WRT held a Consultation Workshop with participants from the mining and minerals, renewable energy and infrastructure sectors. During the workshop, participants evaluated their dependency on different ecosystem services and reviewed hypothetical governance models for green finance schemes. The participants heard presentations on various potential finance models before evaluating these using scenario cards in Figure 4.

Each model has multiple benefits and drawbacks. However, the Community Interest Company scenario had the largest number of benefits.

As a result of attending this workshop, I am more likely to pursue involvement in a climate adaptation project.

Neil Farrington, Director of Celtic Sea Power

Following the workshop, all organisations in attendance expressed interest in hearing about future opportunities to implement Nature-based Solutions to protect their assets from climate impacts and/or fulfil their Environmental Social Governance requirements. For example, the Cornish Lithium company has set clear Environmental Social Governance for successful water management and biodiversity uplift as part of their lithium extraction exploration. This is a highly valuable outcome, as it opens further avenues for possible project co-development and funding/finance, and creates opportunities to overcome broader barriers concerning siloing between the public and private sectors identified in the bankability interviews. This result also highlights opportunities that can be taken forward in the immediate term with smaller companies, as they are more interested in investing to achieve specific outcomes, such as water management and flood risk mitigation, as part of business resilience. These results will help to accelerate investment in Nature-based Solutions for climate change adaptation in the Westcountry region and potentially elsewhere with similar challenges.

Summary

Further Information

Contact

Keywords

Climate Impacts

Adaptation Sectors

Key Community Systems

Countries

Funding Programme

Disclaimer

The contents and links to third-party items on this Mission webpage are developed by the MIP4Adapt team led by Ricardo, under contract CINEA/2022/OP/0013/SI2.884597 funded by the European Union and do not necessarily reflect those of the European Union, CINEA, or those of the European Environment Agency (EEA) as host of the Climate-ADAPT Platform. Neither the European Union nor CINEA nor the EEA accepts responsibility or liability arising out of or in connection with the information on these pages.

Language preference detected

Do you want to see the page translated into ?